Quantum AI

Client Registration Documents Rights and Obligations, Risk Disclosure Document, Do’s and Don’ts in Vernacular Language: BSE NSE. 00 has $200 of potential profit but unlimited maximum loss if the underlying stock rises significantly. It doesn’t have as many bells and whistles as some stock trading apps, but it covers the basics and makes it easy to trade for a very low cost. Powerful tools, real time information, and specialized service help you make the most of your margin trading. I don’t understand what the purpose of switching on two factor authentication or Face ID is for when during some updates it decides to reboot your settings and then you personally have to realise this and go to settings and switch it back on again. Traders sometimes have to make snap decisions. “I love the transparency here. For example, an employee with continuous access to inside information can pass it on to acquaintances with instructions to trade specific stocks related to that information to earn risk free money from that trading. Read more about this on the page How to send encrypted e mails. This enables the app to provide you with an account that you, the app and, yes, tax authorities can link exclusively and reliably to you.

Best Crypto Exchanges Of September 2024

Your ability to open a trading business with Real Trading™ or join one of our trading businesses is subject to the laws and regulations in force in your jurisdiction. Also, gaps can often be caused by news events or market manipulation, which makes this strategy riskier compared to other types of trading strategies. For example, all of the best exchanges should possess top tier security features, but if you’re looking to trade only the main cryptocurrencies, you probably don’t really care too much about the variety of coins available on the exchange. These types of options can only be exercised or assigned on the expiration date, not before. These apply for any market, whether you’re thinking of exploring forex day trading, shares, indices or other financial instruments. You can learn more about trading in Plus500’s free Trading Academy, pocketoption-in-net.biz which offers educational resources like free FAQs, trading how to videos and articles, and informative articles, among other things. Investment Advisors in San Francisco often focus on high growth tech companies, leveraging the area’s culture of innovation to identify and support the next big thing. I advise new traders to immerse themselves in the world of technical analysis, practice spot on risk management and combine the M pattern with other technical tools to maximize their trading potential. Now, if the stock goes against your expectations and drops to Rs. In the following sections, we will discuss the different types of trade to make better decisions and maximise returns. Sarwa shall not be liable for any losses arising directly or indirectly from misuse of information. Access DeFi protocols and get rewarded. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations. INZ000218931 BSE Cash/FandO/CDS Member ID:6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No: IN DP 418 2019 CDSL DP No. You should use stop loss orders to manage your losses just in case the trade is not moving in your preferred direction. Leveraged trading is about using short term strategies in a fast paced trading environment, which can be stressful and demanding. ” – , Trading Analyst. Friday, 13 September 2024. 1 Stock on hand on 31st March 2019 was valued at ₹ 43,000. Additionally, diversification is an important risk management technique. A clear understanding of these patterns helps traders decide when to buy or sell an asset. There are additional risks and challenges such as system failure risks, network connectivity errors, time lags between trade orders and execution and, most important of all, imperfect algorithms. Hi guys, in order to spot a divergence you should be careful which timeframe you’re looking at. ADVISORY – PRECAUTIONS FOR CLIENTS DEALING IN OPTIONS.

FAQs:

Discover how to trade shares with IG. This movement can be as little as a few cents. This daily decrease in time value is often called Theta or time decay. Forex scalping is particularly common for trading currency pairs. This can prevent a hacker from being able to gain access to your crypto. Stop chasing what works for someone else. You should also learn by using the paper trading function that many of the top platforms now offer. Another worthy member of this best crypto app for beginners list is the Kraken app. The leverage rate or margin requirement varies based on the instrument EUR/USD, UK 100, Gold and asset class forex, indices, commodities. “Adjusted Debit Balance. In 2020, the market was back to hitting record highs by August. I had very limited exposure to the stock market prior to the GTF Options Live class but I feel much more ready to trade in the market after learning the strategy here. Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. In a short call option strategy, an investor sells call options on something they don’t own. Note whether your stop loss order or price target would have been hit. There are no laws prohibiting paper trading given its risk free nature using fake money and positions. Therefore, his overall profit from the transactions is –. Real time quotes are free with a $1,000 balance. The platform is secure and transparent, being listed on the stock exchange and disclosing all financial information. The trader makes a profit only if the spot price is below 90. The world of cryptocurrency trading can be confusing, especially for those new to the game. You could take that off their hands for a small monthly fee – promising to keep their site secure, implement content updates, and provide some SEO search engine optimisation services.

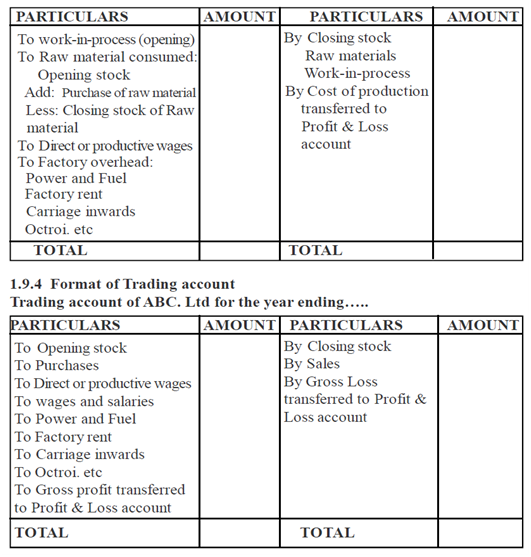

Format

This account type and lot size is ideal for low risk trading, small investments or more precise risk. Don’t put too much money in one stock that, if you lose the money, you’re going to be hurting. Just like you need to know the rest of the alphabet to be able to make sentences, you need to inculcate certain habits to help you get to the foothills of financial success, and prepare you for the climb that lies ahead. Intraday Trading Indicator: When it comes to booking profits in intraday trading, you must conduct an extensive study. Fidelity is just one of 26 online brokers that we evaluated based on 89 criteria, including available assets, account services, user experience, and additional features. They go to enormous lengths to protect your privacy and you are protected against the loss of cash and securities by the Security Investors Protection Corporation if, for some reason your broker is financially distressed up to $500,000 in securities and $250,000 in cash per customer. While it’s not always easy, new investors can take a number of steps to begin investing successfully, including finding a style that works to grow their portfolio over time. In many jurisdictions, companies are required to disclose insider transactions to regulatory bodies such as the Securities and Exchange Commission SEC in the United States or equivalent regulatory authorities in other countries. With the 10 and 20 day SMA swing trading system you apply two SMAs of these lengths to your stock chart. Your investing decisions will play a far bigger part than the risk of fraud or theft in determining whether your portfolio is safe. BlackBull Group UK Limited is registered in the United Kingdom, Company Number – 9556804. Most brokerage accounts are protected by the Securities Investor Protection Corporation, or SIPC. Yes, you can hold intraday shares. This marks the start of continuous trading of hourly products and, since 9 December 2014, the opening auction of quarter hour products. Users can take advantage of Crypto. However, it’s typically challenging for novices and often a losing way for newer investors to trade.

Do paper trading simulators expire?

However, a day trader with the legal minimum of $25,000 in their account can buy $100,000 4× leverage worth of stock during the day, as long as half of those positions are exited before the market close. So, if algorithmic trading is easier from the psychological standpoint, what is then that makes it psychologically demanding. This is the best choice if you want to entertain yourself and earn some money. Technical analysis in financial markets relies on historical price patterns to identify potential future trends. Investors should review investment strategies for their own particular situations before making any investment decisions. That’s when shady people purchase buckets of shares in a little known, thinly traded company and hype it up on the internet. That depends on your broker. Makes you wonder if the “S” in NYSE stands for “Stock” or for “Scrawny”. Best for: Beginner crypto trading; hassle free and secure crypto storage.

Timing Your Entry: When to Buy

AI trading platforms can automate the backtesting process, making it faster and more accurate. In this blog, we will look at the roll up merger’s meaning, processes, benefits, and key success factors. You’re never going to be right nine times out of ten. Ratchet down that 10% if you don’t yet have a healthy emergency fund and 10% to 15% of your income funneled into a retirement account. The minimum brokerage fee charged is 0. This helps limit losses on any given trade. Access and download collection of free Templates to help power your productivity and performance. Strong portfolio analysis and account features. Here’s how we make money. Online stock brokers, meaning companies like ETRADE and Fidelity, allow you to buy and sell stocks. “I’m always thinking about losing money as opposed to making money. The platform features advanced tools like TradingView and Charts IQ libraries, making it ideal for advanced and seasoned investors. FREE TRAINING FROM LEGIT FOUNDERS. You’ll notice our top choices in this listing also rank highly in other brokerage, robo advisor and crypto exchange listings we’ve conducted. The best stock trading apps provide useful features, goal building mechanics, and accessible trading strategies. Stay aware of timely CEX. The most basic accounts on offer are. 4 billion about $223 billion in 2024 dollars. When do I pay minimum commission fees for stocks. By providing companionship, pets also combat loneliness, a common issue for traders who spend long hours in front of screens. There are also some basic rules of day trading that are wise to follow: Pick your trading choices wisely. Always do as much research as you can before entering the live markets and get your demo account to hone your skills. IG Groups total shares. Beginner friendly exchanges like Coinbase and Gemini offer quick buy features that charge higher fees. Once you have developed your trading plan, you can test it out by doing some paper trading, an approach you can use before you put your capital at risk. Beginners wanting to test out trading forex in a simulated trading environment can try out their strategies on the paperMoney platform on thinkorswim. Nil account maintenance charge after first year:INR 300.

Other Resources

Billing Accounting and Inventory software for small business owners in India. There’s no doubt that it is a user friendly app. Discover OANDA, the smarter forex trading app. Our aim is to provide you with diverse trading opportunities without worrying about the cost impact of brokerage fees. Our receipt of such compensation shall not be construed as an endorsement or recommendation by StockBrokers. The base salary of an entry level day trader as of 2020 was in the $50,000 to $70,000 range. To determine the best trading platforms for beginners, our team of experts started by evaluating 24 brokerage firms and investment platforms — from large, legacy brokerages to relatively new financial technology fintech companies. Here’s how you earn a profit. Share Market Holiday 2024. 8, you’d close your position by selling at the new sell price of $6888. Keep in mind that paper trading is not a substitute for trading with a real account. Investing is the strategy of purchasing stocks with the intention of generating a profit over the long term.

Bullish Marubozu Pattern

This means they can trade larger positions but also face more significant risks. Besides that, you can earn through a variety of DeFi activities including mining, yield farming, and so on. This is usually reserved for traders who work for larger institutions or those who manage large amounts of money. 100+ indicators and customizable algorithms. Store and/or access information on a device. If you have questions about your existing FX and CFD account, our team is happy to help. Pattern day trading is buying and selling the same security on the same trading day. A market maker is basically a specialized scalper and also referred to as dealers. There’s a caveat: Newer traders in the market have lured in fraudsters looking to take advantage of less knowledgeable investors.

Things to know before you invest in Tesla!

Trading on margin means borrowing your investment funds from a brokerage firm. A trader can buy or sell currencies in the forward or swap markets in advance, and lock in a specific exchange rate. Thanks to ongoing enhancements, ETRADE’s two mobile apps are lean, yet comprehensive enough to provide both investors and traders with the right mix of what matters most in an intuitive mobile experience, including robust portfolio and risk management capabilities, deep research, easy to digest education, innovative tools and features, and more. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. Large positions will always be reflected in larger volume bars, which can confirm the market’s next upward or downward move. The platform has an excellent reputation in the market and has a large user base, which makes it a reliable option for beginners. ESMA’s questions and answers on the Market Abuse Regulation, last updated on 6 August 2021. Let’s discuss the shortcomings of the swing style of trading. We are transferring you to our affiliated company Hantec Trader. Essentially, you’re putting down a fraction of the full value of your trade, and your provider is loaning you the rest. So it’s important for people to say that the volatility that they’re seeing on the upside, they’ll also see on the downside. Zero Commission on Mutual Fund Investments, 24/7 Order Placement. Revolutionizing the realm of digital trading, Quantum AI stands out as a premier global cryptocurrency platform. The purchaser of a contract can make money if the value of the underlying security or index rises above in the case of a call or falls below in the case of a put the strike price of their options contract by more than the premium paid. Here’s a list of days when banks are closed for the holidays, too. Algorithmic trading also called automated trading, black box trading, or algo trading uses a computer program that follows a defined set of instructions an algorithm to place a trade. Support and resistance levels are often useful information when determining a course of action. This counts as 1 day trade because you opened and closed the ABC stock position the same day. Now, worldwide traders have more investment options than ever to pick their preferred type of trading style. Let’s say, after doing some research on commodities, you believe the spot gold price will increase from its current level of $1,809. Time: Intraday trading involves closing positions within the day, while delivery trading involves holding them for a longer period.

Dive into the World of Paper Trading Websites

An interface designed for speed, bringing together all useful information. AssignmentThe assignment of an option writer seller obligates the writer to sell in the case of a call or purchase in the case of a put the underlying security at the specified strike price. Firms that facilitate retail trading, such as Robinhood, do not offer margin accounts to most traders, so the PDT rule does not apply to most amateur or retail traders. From understanding market basics to developing a solid trading plan, these strategies will set traders on the path to success. Best for: Traders looking for a trusted platform with a long track record. The algorithm buys shares in Apple AAPL if the current market price is less than the 20 day moving average and sells Apple shares if the current market price is more than the 20 day moving average. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Markets rise, and markets fall. The cookie acts as a technical support that facilitates your use of this website. In return for granting the option, the seller collects a payment known as a premium from the buyer. And thinkorswim customers are allowed to access either of those Schwab platforms without needing to create an additional account on those platforms. One of the best methods to train your “chart eye” to see these patterns is to simply replay the market, noting each time you see a particular candle. The percentage price oscillator is a technical momentum indicator that plots the difference between two moving averages, where one of these lines has been shifted by an amount proportional to gains on stock. The term position trader refers to a type of trader who holds investments for a long period of time. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free floating currency system. John Wiley and Sons, 2016. Vantage offers three different types of accounts – The Standard STP Account, Raw ECN Account, and Pro ECN Account – suitable for all types of traders interested in copy trading. With us, you can use paper trading or backtesting on platforms like MetaTrader 4 and ProRealTime to customise your trading experience according to your preferred specifications. Conduct your own due diligence before making any financial decisions. Because options contracts have an expiration date, which can range from a few days to several months, options trading strategies appeal to traders who want to limit their exposure to a given asset for a shorter period of time. ” Traders Press, 1990. Com website to trade.

Enjoy Zero Brokerage on Equity Delivery

The most sustainable and proven way to make money is to do so gradually. Simple and easy to use user interface. Quotex does not offer a bonus on the website but they are available once you begin the deposit process. Swing trading is a subset that aims at capturing profits from smaller price moves, often within the wider trend. Trade 26,000+ assets with no minimum deposit. They’re always quick torespond, super helpful, and care about sorting out any problemsyou might have. This real time insight enables the trader to identify potential entry and exit points swiftly. Or if you’re a newcomer to the crypto space, you might want to look into exchanges with robust learning programs. Meaning, it is more accurate on higher time frames and generates more false signals on lower time frames. The information provided herein is intended solely for educational purposes and does not constitute investment advice. There are mainly 3 types of chart patterns. I know of Robinhood but they already broke my trust with their actions with GameStop. Pattern day traders—those who execute four or more day trades within five business days—must maintain a minimum account balance of $25,000 and can only trade in margin accounts. The value of investments can fluctuate and may result in losses.

Showing 0 of 5 selected Companies

Individual traders don’t necessarily have 100,000 dollars, pounds or euros to place on every trade, so many forex trading providers like tastyfx offer leveraged products that allow traders to open a full lot of EUR/USD for only euro sign 2000 of initial margin. Swing trading is a technique that lets you synchronize with the market’s rhythm. Trading Option Greeks was reviewed by top experts on option trading books. Since American options offer more flexibility for the option buyer and more risk for the option seller, they usually cost more than their European counterparts. Cryptohopper’s highly versatile platform is the ultimate solution for customizable crypto trading regardless of your skill level. If a stock price moves higher, traders may take a buy position. These aren’t just repositories of data but centers of learning that excel in breaking down the complexities of investing into manageable, understandable bits. Gain insights into range trading strategies and techniques for consistent profits. Reading a tick chart is similar to how a trader reads other charts – you can still look for support and resistance, price breakouts, and trends. The instantaneous insights gained from tick charts empower day traders to make intelligent and informed decisions, reacting promptly to diverse market situations. Carefully consider the cryptocurrencies available on a given exchange. Contracts for difference CFD are leveraged products and carry a high level of risk to your capital as prices may move rapidly against you. Of algo strategies you can deploy. 10 per order that offers a low cost trading experience to clients.