Forex trading charts are essential tools for anyone looking to navigate the exciting world of currency trading. They provide crucial visual data that can help traders make informed decisions based on market trends. Understanding these charts is key to developing a successful trading strategy. In this article, we will delve into the different types of Forex trading charts, how to read them, and offer tips to elevate your trading game. For more detailed insights, visit forex trading charts https://forex-exregister.com/.

Types of Forex Trading Charts

There are several types of Forex trading charts that traders can use to analyze market data. The most commonly used are:

1. Line Charts

Line charts are one of the simplest types of charts. They display a single data series as a continuous line connecting significant data points over a specific period. Line charts are useful for identifying overall trends over time, but they may not display all market information, such as price movement within a specific time frame.

2. Bar Charts

Bar charts provide more information than line charts. Each bar on a chart represents the open, high, low, and close (OHLC) prices of a currency pair for a specific time period. The length of the bar shows the price range, and the horizontal lines indicate opening and closing prices. Bar charts are helpful for gauging market volatility and price movements over time.

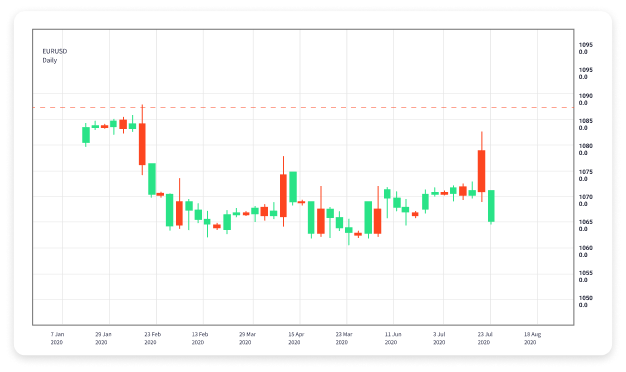

3. Candlestick Charts

Candlestick charts have gained immense popularity among Forex traders due to their visual appeal and the information they convey. Each candlestick represents a specific time interval and displays the open, high, low, and close prices. The body of the candle is filled or empty, indicating whether the price closed higher or lower than it opened. Traders often use candlestick patterns to predict potential market reversals or continuations.

How to Read Forex Trading Charts

Regardless of the chart type, reading Forex trading charts effectively is crucial for success. Here are some essential steps to analyze charts:

1. Identify the Time Frame

The first step is to choose a time frame that suits your trading style. Short-term traders might prefer 1-minute or 5-minute charts, while long-term traders may look at daily or weekly charts. Different time frames provide different insights into market trends.

2. Analyze Price Action

Observe how the price moves over time. Look for trends, reversals, and support and resistance levels. Trendlines can be drawn to identify upward, downward, or sideways trends, helping traders make predictions about future price movements.

3. Utilize Indicators

Incorporating technical indicators—such as moving averages, Relative Strength Index (RSI), and Bollinger Bands—can enhance your chart analysis. Indicators can help traders gauge overbought or oversold conditions, trend strength, and potential entry or exit points.

Common Chart Patterns

Chart patterns are formations created by price movements and can signal potential future price behavior. Here are some common patterns to watch for:

1. Head and Shoulders

This pattern indicates a reversal in trend and consists of three peaks: a higher peak (head) positioned between two lower peaks (shoulders). When identified, it can signal a change from bullish to bearish sentiment, or vice versa.

2. Triangles

Triangles are continuation patterns that can be ascending, descending, or symmetrical. They represent a period of consolidation before the price continues in the prevailing trend direction.

3. Flags and Pennants

These short-term continuation patterns indicate a brief pause in the market following a strong price movement. Flags resemble rectangular shapes, while pennants look like small symmetrical triangles. Traders often enter trades in the direction of the previous trend when price breaks out of these formations.

Tips for Enhancing Your Chart Reading Skills

To further develop your ability to read Forex trading charts, consider the following tips:

1. Practice Regularly

The more you engage with Forex charts, the more familiar you will become with interpreting them. Daily practice is key to honing your skills.

2. Keep a Trading Journal

Document your trades and chart analyses in a journal. This practice will help you identify successful strategies and areas for improvement. Reviewing past trades fosters growth and better decision-making.

3. Stay Updated on Market News

Understanding the economic factors that influence currency movements can provide invaluable context for your chart analyses. Stay informed by following financial news and economic reports related to the currencies you trade.

Conclusion

Forex trading charts are powerful tools that can significantly impact your trading success. By understanding the various types of charts, learning to read them effectively, and recognizing patterns, you can make more informed trading decisions. Remember that practice and continual learning are essential in the ever-evolving Forex market. With the right knowledge and skills, you can master Forex trading charts and improve your trading strategies.