Pocket Option Minimum Deposit: A Comprehensive Guide

In the ever-evolving world of online trading, choosing the right platform is crucial for both beginners and seasoned traders. One of the most appealing aspects of Pocket Option is its low minimum deposit requirement. In this guide, we will explore the details of the Pocket Option Minimum Deposit setoran minimum Pocket Option, the advantages of this trading platform, and how to get started.

Understanding Minimum Deposit Requirements

Minimum deposit refers to the least amount of money a trader must deposit into their account to start trading. For many online trading platforms, this amount can be a significant barrier to entry for new traders. However, Pocket Option has established itself as a frontrunner by offering a remarkably low minimum deposit, making it accessible to a broader audience.

What is the Minimum Deposit for Pocket Option?

The minimum deposit for Pocket Option is just $10. This competitive threshold allows traders with limited budgets to participate in financial markets without the risk of losing large sums of money upfront. By setting such a low entry point, Pocket Option opens the door for many individuals who might otherwise shy away from trading.

The Advantages of a Low Minimum Deposit

A low minimum deposit has several advantages, especially for inexperienced traders:

- Accessibility: A low financial barrier means anyone can start trading. Aspiring traders can hone their skills with less risk before committing larger amounts of money.

- Flexibility: With a smaller initial investment, traders have the flexibility to allocate their funds to a variety of assets, strategies, or trading styles.

- Learning Opportunity: Beginners can leverage the low minimum deposit to learn the ins and outs of trading without the fear of significant financial loss.

- Testing the Platform: A minimal deposit allows users to test the trading platform’s features, tools, and customer services before making a larger investment.

How to Deposit Funds into Pocket Option

Depositing money into your Pocket Option account is straightforward. Here’s how you can do it:

- Create an Account: Sign up on the Pocket Option website. This process is quick and requires only a few personal details.

- Select a Deposit Method: Pocket Option supports various deposit methods, including credit cards, e-wallets, and cryptocurrencies.

- Deposit Funds: Choose your preferred payment method and enter the amount you wish to deposit, with a minimum of $10.

- Confirm Your Deposit: Follow the prompts to complete your deposit. Ensure that all your details are correct before final confirmation.

Trading with Pocket Option

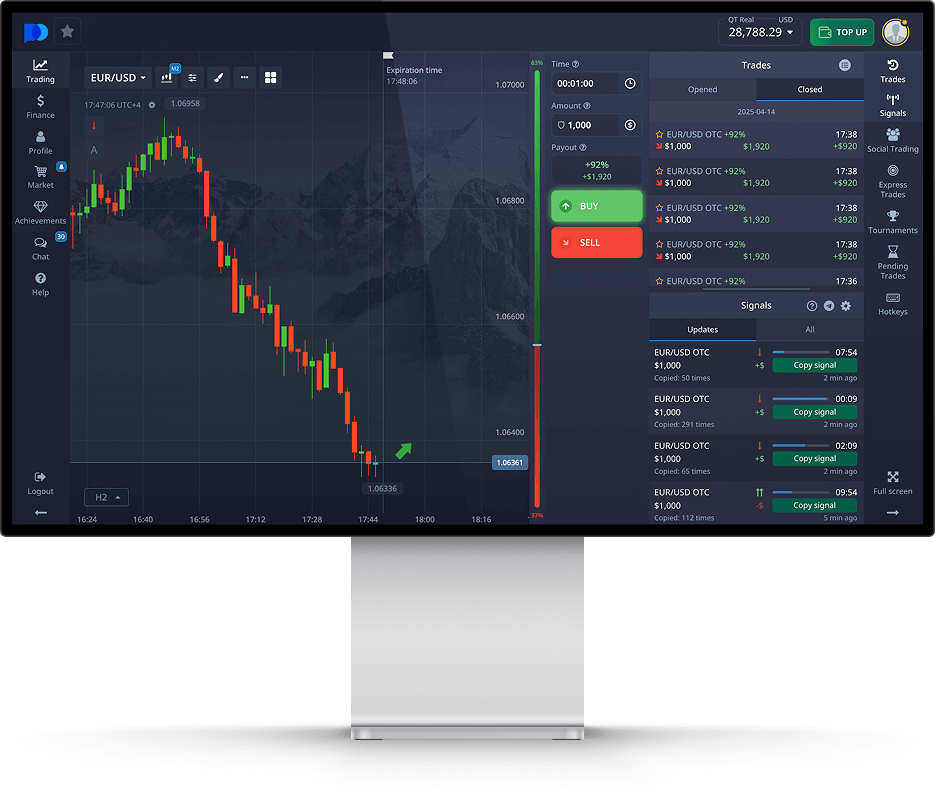

Once your funds are deposited, you can start trading immediately. Pocket Option offers an intuitive interface suitable for both novices and experienced traders. The platform provides various tools and features, including:

- Multiple Trading Instruments: Trade forex, cryptocurrencies, stocks, commodities, and more.

- Diverse Account Types: Different account types cater to varying trading styles and levels of experience.

- Social Trading: Engage with a community of traders, share strategies, and view successful trades.

- Demo Account: Practice trading without any financial risk using a demo account which mimics real market conditions.

Managing Your Trading Account

Proper account management is crucial for long-term trading success. Here are some tips:

- Set a Budget: Decide how much you are willing to invest and stick to that budget.

- Use Stop-Loss Orders: These can help minimize losses on trades that do not go as planned.

- Withdraw Regularly: Consider withdrawing profits regularly to ensure you are not left with all your funds in the trading account.

Conclusion

Pocket Option’s low minimum deposit requirement is a significant advantage for those looking to get into online trading. At just $10, it offers accessibility, flexibility, and a great opportunity for traders to build their skills without making large financial commitments. By leveraging the tools and resources available on the platform and practicing prudent account management, traders can maximize their chances of success in the financial markets.