Цифровые кошельки

Due to the court stays, the financial services industry remains subject to the previous five-part test from a 1975 DOL regulation. Under this standard, professionals are considered a fiduciary when providing investment advice if they meet all the following criteria:

Individual investors have a range of personal goals, risk preferences, and resources https://www.nonnagrishaeva.ru/press/pages/kak-rabotaiet-ts-upis-v-bet-boom-osobiennosti-rieghistratsii-i-vyvoda-sriedstv.html. Their objectives include saving for retirement, accumulating wealth for large purchases, funding education for children, or building an emergency fund. Each goal requires a different strategy or risk profile.

Track your asset allocation and calculate your portfolio diversity across FACTSET investment classifications or your own groupings with the Diversity Report. This makes it easy to rebalance your portfolio to your target asset allocation.

Allows flexibility in adjusting asset allocation based on short-term market forecasts or changes in economic conditions. Portfolio managers actively make allocation decisions to capitalize on perceived opportunities or mitigate risks.

Portfolio management considers tax implications to minimize the tax burden on investment returns. That may involve strategies like tax-loss harvesting or investing in tax-efficient vehicles such as index funds or ETFs.

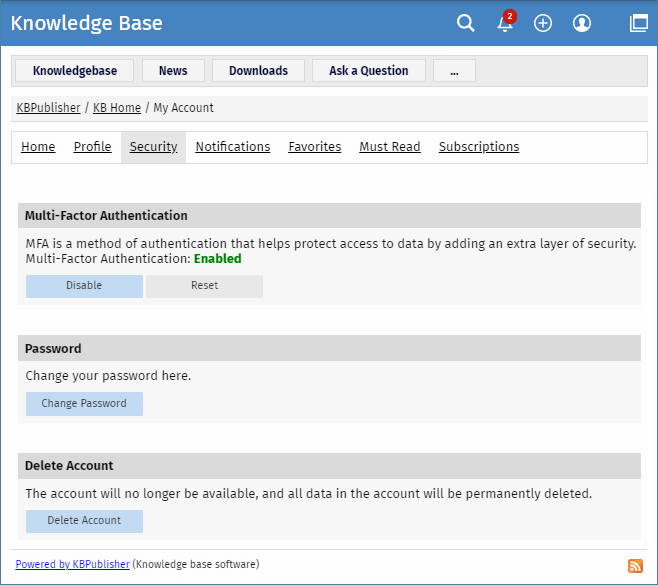

Account security system

The topic of account management is primarily found in Security+ domain 4 (Security Operations) of the CompTIA Security+ exam. Exam objective 4.6 is “Given a scenario, implement and maintain identity and access management.”

Account security is a critical component of securing privileged access. End to end Zero Trust security for sessions requires strongly establishing that the account being used in the session is actually under the control of the human owner and not an attacker impersonating them.

You can implement external identity providers alongside your existing internal authentication system using a platform such as Identity Platform. There are a number of benefits that come with Identity Platform, including simpler administration, a smaller attack surface, and a multi-platform SDK. We’ll touch on more benefits throughout this list.

The topic of account management is primarily found in Security+ domain 4 (Security Operations) of the CompTIA Security+ exam. Exam objective 4.6 is “Given a scenario, implement and maintain identity and access management.”

Account security is a critical component of securing privileged access. End to end Zero Trust security for sessions requires strongly establishing that the account being used in the session is actually under the control of the human owner and not an attacker impersonating them.

Reliable broker for beginners

Online trading is safe if you use a regulated online stock broker and never invest more than you are willing to lose. Trading stocks online is inherently risky. A good rule of thumb is to never invest more than you can afford to lose or that you might need within the next three months. Start with a small amount of money, read investing books, and keep it simple by buying and holding for the long term rather than trying to time the market.

Charles Schwab is a terrific all-around choice for everyday investors that offers a thorough educational experience and support for beginners, with its Choiceology podcast a standout. Paper (practice) trading is not available, however. Read full review

Embarking on your investing journey can feel daunting — we get it. At The Motley Fool, we’ve been covering investing for over 30 years, so we understand how overwhelming it can feel to navigate the complexities.

Online trading is safe if you use a regulated online stock broker and never invest more than you are willing to lose. Trading stocks online is inherently risky. A good rule of thumb is to never invest more than you can afford to lose or that you might need within the next three months. Start with a small amount of money, read investing books, and keep it simple by buying and holding for the long term rather than trying to time the market.

Charles Schwab is a terrific all-around choice for everyday investors that offers a thorough educational experience and support for beginners, with its Choiceology podcast a standout. Paper (practice) trading is not available, however. Read full review

Embarking on your investing journey can feel daunting — we get it. At The Motley Fool, we’ve been covering investing for over 30 years, so we understand how overwhelming it can feel to navigate the complexities.